how are annuities taxed to beneficiaries

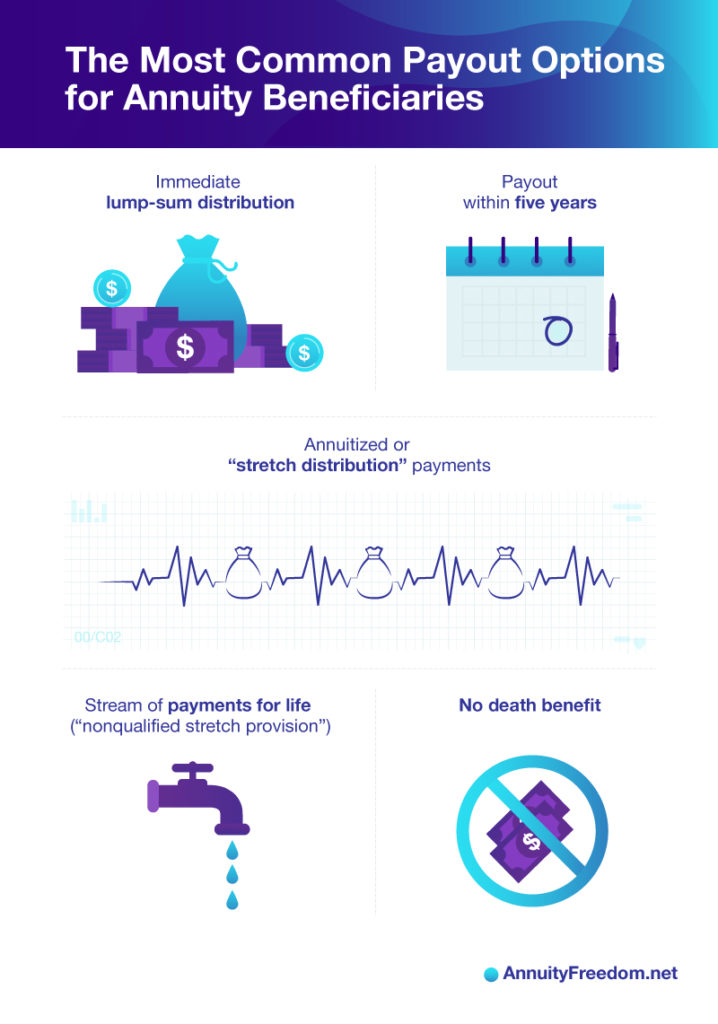

The bonus will offset the taxes owed. The problem with taking a one-time lump sum is that you trigger tax on the entire amount of deferred income that the annuity generated.

Annuity Beneficiaries Inheriting An Annuity After Death

It depends on your contributions.

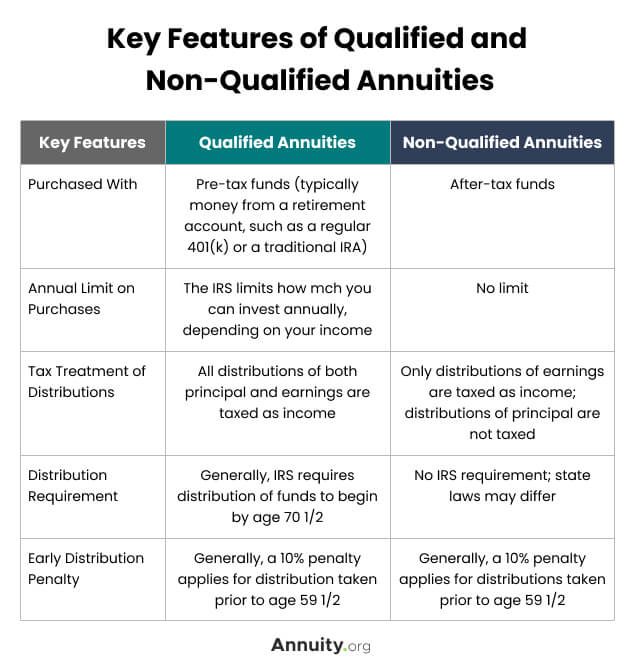

. Income taxes on the gain. In most cases non-qualified annuities can remain tax deferred all the way until the death of the owner. Annuities are popular investments because the earnings are tax-deferred until.

If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments. Taxes are the same if you inherit an annuity as the beneficiary. When an annuity payment is made 50 of each payment would be income taxable.

When an annuity owner dies the person or people identified as beneficiaries receive the annuity balance and must pay taxes on that amount. Ad Annuities help you safely increase wealth avoid running out of money. While you can open an annuity as a retirement plan -- such as an individual retirement.

Annuity Owner Dies before the age. Have a 500k portfolio. A beneficiary can reinvest the inheritance with a deferred annuity that offers a premium bonus.

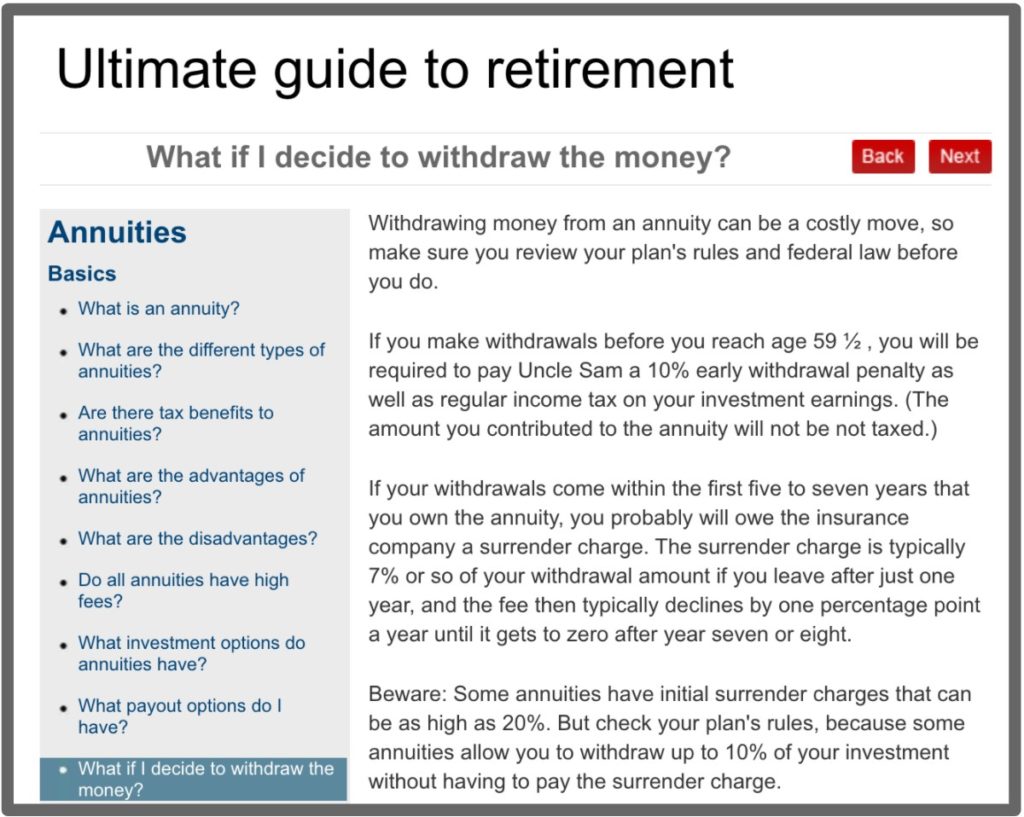

Taxability of Annuities for Beneficiaries. An annuity contract provides for tax-deferred growth of the money invested and an option to turn a lump-sum amount into a guaranteed income. Your annuity income payments are classed as earned income and are subject to income tax just like the salary you will have received during your working life.

Get this must-read guide if you are considering investing in annuities. Annual payments of 4000 10 of your original investment is non-taxable. How are non qualified annuities taxed to beneficiaries.

Everything You Need To Know. Tax Benefits for Annuity Beneficiaries. Taxes at Death.

Read our guide for a wealth management perspective on annuities. Ad Learn the pros and cons of annuities and why an annuity may not be a good investment. Depending on.

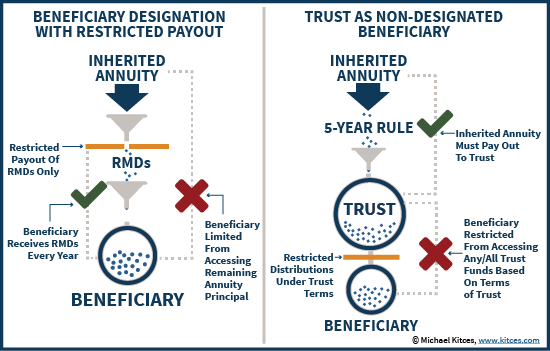

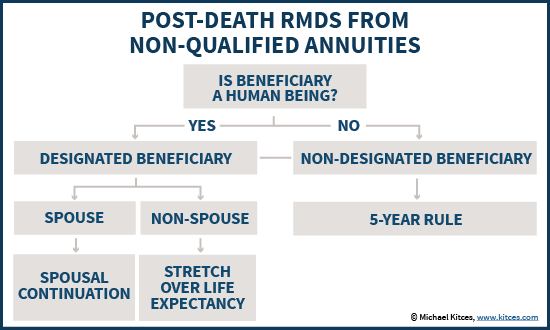

Ad Annuities are often complex retirement investment products. Different tax consequences exist for spouse versus non-spouse beneficiaries. Tax Consequences of Inherited Annuities.

So if the annuity buyer paid 10000. Surviving spouses can change the original contract. These payments are not tax-free however.

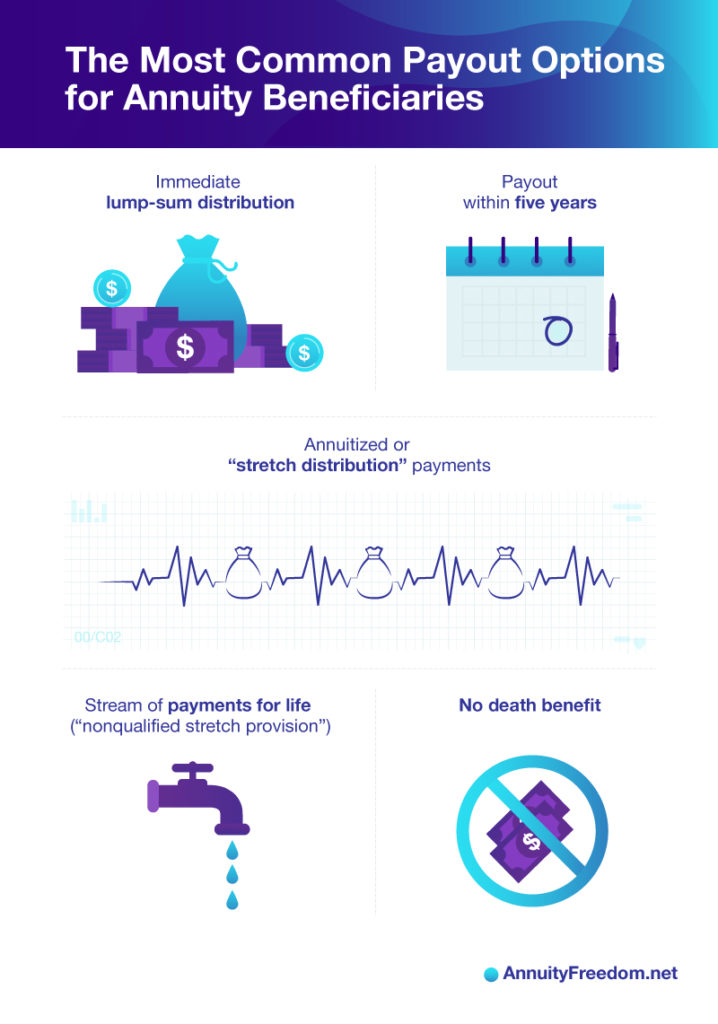

Tax on Annuity Change of Ownership. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. Ad Annuities are often complex retirement investment products.

Learn some startling facts. Annuities provide guaranteed returns by participating in market gains but not the losses. You live longer than 10 years.

Annuity contracts are a common long-range savings option. This so-called inherited annuity is the outcome. As such a principal that is paid into an inherited or purchased annuity that has already been taxed will not be.

Learn some startling facts. The variable annuity contract may provide that at your death a person you name as a beneficiary will receive a lump-sum death benefit. Ad Learn More about How Annuities Work from Fidelity.

Find Useful And Attractive Results. Get this must-read guide if you are considering investing in annuities. Considering the Beneficiary of Your Annuity.

You have an annuity purchased for 40000 with after-tax money. Your relationship to the beneficiary matters when it comes to annuity payments and taxation so. The taxation of any annuity which has been inherited by a beneficiary will be dictated by the age of the original owner upon their death.

FindInfoOnline Is The Newest Place to Search. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Ad Search For Are Inherited Annuities Taxable.

Annuities are insurance contracts that offer unique guarantees and tax deferral and they are commonly used to save for retirement.

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Trust Vs Restricted Payout As Annuity Beneficiary

Qualified Vs Non Qualified Annuities Taxation And Distribution

Annuity Beneficiaries Inheriting An Annuity At Death 2022

Taxation Of Annuities Explained Annuity 123

Annuity Beneficiaries Inheriting An Annuity After Death

Trust Vs Restricted Payout As Annuity Beneficiary

Annuity Taxation How Various Annuities Are Taxed

Inherited Non Qualified Annuities For Spouses Non Spouses And Trusts

Annuity Beneficiaries Inheriting An Annuity At Death 2022

Inherited Annuity Tax Guide For Beneficiaries

Annuity Taxation How Various Annuities Are Taxed

Annuity Taxation How Are Annuities Taxed

Annuity Beneficiaries Inherited Annuities Death

How Are Annuities Taxed For Retirement The Annuity Expert

What Is An Annuity How Does An Annuity Work For Retirement

Annuity Beneficiaries Inheriting An Annuity After Death

Annuity Tax Consequences Taxes And Selling Annuity Settlements